Most people don’t fail at budgeting because they’re bad with money - they fail because most budgets were built for a world that no longer exists.

Traditional budgeting assumes you get paid the same amount every two weeks, spend the same every month, and have the time or patience to track every transaction by hand. But real life isn’t like that anymore. Income fluctuates. Expenses shift. Life moves faster. And the tools we use to manage money should evolve just as quickly.

That’s where the modern budget comes in – a flexible, automated system that adapts to your lifestyle instead of forcing you to fit inside a spreadsheet. A modern budget doesn’t guilt you into saving; it builds good habits quietly in the background so you can focus on what matters most - living your life.

In this guide, you’ll learn how to build a budgeting system that actually works – one that combines smart structure with automation, so your finances stay on track with less effort.

Before we dive in, grab your free Modern Budget Template below – we’ll use it throughout the guide to help you build your own simple, sustainable money system.

Why Traditional Budgets Don’t Work

If you’ve ever opened a budgeting spreadsheet, entered your income, and started building categories for groceries, coffee, rent, and “miscellaneous,” you know how quickly it all falls apart.

Traditional budgets are built on perfect-world assumptions: that your income is predictable, your spending is consistent, and your motivation never fades. In reality, none of those things hold true.

1. They’re Built for Stability – Not Real Life

Classic budgeting frameworks were designed in an era of steady paychecks and fixed expenses. But modern life is fluid: side gigs, irregular pay cycles, shared subscriptions, fluctuating bills. A rigid, month-by-month plan simply can’t keep up with that kind of movement.

2. They Demand Too Much Effort

The average person makes dozens of small purchases each week. Logging each one manually — or even categorizing them — quickly becomes a chore. Once that friction sets in, consistency collapses. The budget stops being a tool and becomes a burden.

3. They Focus on Restraint Instead of Behavior

Traditional budgets are about saying “no.” They treat spending as failure and saving as punishment deferred. That mindset doesn’t motivate; it burns people out. Modern systems work better when they build automatic habits that remove willpower from the equation.

4. They Ignore Psychology

Budgets often overlook the emotional side of money - the way habits, stress, and environment shape financial behavior. That’s why so many people “budget” for two weeks and then relapse: the system fights human nature instead of working with it.

💡 Reality check: According to studies, over 60% of people abandon their budgets within three months. The problem isn’t discipline – it’s design.

Traditional budgeting fails because it tries to control your money through rigidity. A modern budget succeeds because it creates structure through automation, flexibility, and feedback – not guilt.

Next, we’ll look at what makes a modern budget different, and how it can help you finally build a system that fits your real financial life.

What Makes a Modern Budget Different

A modern budget isn’t about tracking every dollar – it’s about designing a system that runs quietly in the background, supporting your goals with as little manual effort as possible.

Traditional budgeting was about control. Modern budgeting is about flow. It treats money as something that moves through your life – toward bills, savings, investments, and experiences – and helps you guide that flow automatically.

1. Automation Comes First

Modern automation goes far beyond simple transfers. Your money can now move, categorize, and optimize itself across accounts with almost no effort. Tools like Monarch, Tiller, and Copilot sync transactions in real time, analyze trends, and flag issues automatically.

Automation isn’t just about convenience – it’s about designing a system where your best financial decisions happen by default. The less you need to think about managing your money, the more energy you have for actually living your life.

2. Simplicity Beats Granularity

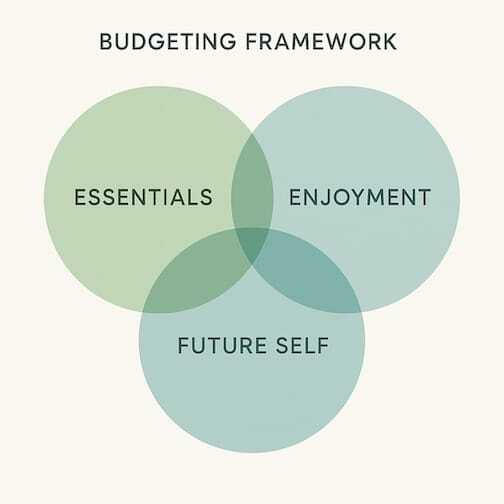

You don’t need 42 budget categories. You need a few big-picture ones that actually reflect your values — like Essentials, Enjoyment, and Future Self.

Modern budgets simplify the mental load. Instead of tracking “coffee vs. dining out,” you track “lifestyle spending” and move on.

3. Real-Time Visibility, Not Monthly Reviews

Waiting until month-end to see what happened is outdated. Modern tools — apps like Monarch, Copilot, or YNAB — sync directly with your accounts to give you instant insight.

That real-time feedback loop means you can adjust behavior before it’s too late, instead of realizing after the fact that your grocery budget exploded.

4. Behavior-Driven, Not Guilt-Driven

Modern budgeting systems are designed to work with human psychology, not against it. They celebrate small wins, show progress visually, and minimize shame.

A system that feels good to use is a system you’ll actually stick with.

How to Build a Modern Budget (Step-by-Step)

A modern budget isn’t a document — it’s a set of actions you repeat until they become habits.

It’s not about predicting every expense or tracking every coffee. It’s about making your money move in ways that reflect your priorities, automatically and consistently.

Step 1 – Start with Priorities, Not Numbers

Before thinking about where your money goes, decide what it’s for.

What do you actually want your money to do for you this year?

Pick one or two priorities – something concrete and motivating. Some examples are:

Build a $5,000 safety cushion

Pay off one credit card

Save for a trip, wedding, or break from work

Start investing regularly

When you define what matters most, everything else becomes a trade-off against those goals — not an arbitrary rule.

Then divide your money into three broad purposes:

Essentials (Security): what keeps your life stable

Enjoyment (Lifestyle): what makes life enjoyable

Future Self (Growth): what creates options tomorrow

There’s no single right way to balance these – it’s something you’ll keep adjusting as your life and priorities evolve.

Step 2 – Turn Cash Flow into a System

Modern budgeting is about direction, not just documentation.

The key is to build systems that keep money flowing toward your goals without constant effort.

Take actions that make those flows automatic:

Split your paycheck so savings and investing happen first.

Move fixed bills to autopay so they’re never missed.

Keep all flexible spending on one card and give it a monthly ceiling.

Set alerts when you approach your limit, so you can adjust before it’s too late. Most major card issuers, including Discover, Citi, Chase, American Express, and Bank of America, allow you to set balance alerts

Think of your money as a river: if you set the right channels once, it keeps flowing where you want it to go.

Step 3 – Build Feedback Loops

Budgets fail when you stop looking at them. A modern system thrives on feedback, not guilt.

Keep a light touch:

Glance at your banking or finance app once a week — not to judge, but to learn.

Notice where your money actually goes and whether it aligns with your goals.

Make one small correction each month — not ten.

The point isn’t to chase perfection; it’s to create awareness that compounds into better behavior over time.

Step 4 – Adjust as Life Changes

Money isn’t static, and neither is your budget. Promotions, moves, new goals, or unexpected costs all require adjustments.

Modern budgeting assumes change — and adapts.

When your situation shifts:

Revisit your priorities first.

Reallocate funds between Essentials, Enjoyment, and Future Self.

Increase automation wherever friction appears.

A budget that stays flexible stays alive.

Step 5 – Keep It Human

Financial systems only work if they make sense emotionally.

You’re not a spreadsheet — you’re a person with moods, seasons, and trade-offs.

Leave room for enjoyment so saving doesn’t feel like punishment. Celebrate progress, not perfection.

And when you fall off track (because everyone does), simply reset the flow and keep going.

The Core Habit

If you remember nothing else:

Budgeting isn’t only about tracking money — it’s about directing it.

Every action that makes your money move intentionally — automatically, consistently, and in alignment with your goals — is budgeting.

Do that, and you’ll build a system that works even when you’re not watching it.

Build Your Modern Personal Finance Tech Stack

Your finances run better when they’re supported by the right tools — not dozens of them, just enough to automate, visualize, and simplify your money life.

Think of your setup as a tech stack: a connected system where each layer handles one part of your financial life — from spending and saving to investing and long-term planning.

Below is a blueprint for building yours.

1. Expense Tracking & Cash Flow Control

Goal: See where your money goes automatically, without manual tracking.

Recommended tools:

Rocket Money – automatically tracks expenses, identifies recurring subscriptions, and helps cancel unwanted ones.

Monarch Money – excellent all-in-one dashboard for budgeting, goals, and shared household finances.

Copilot – AI-assisted categorization and trend analysis.

YNAB (You Need a Budget) – envelope-style budgeting for those who want intentional control.

Tiller Money – connects to Google Sheets for spreadsheet power users.

Pro tip:

Connect all bank and credit accounts through Plaid once. Then check your dashboard weekly — not to judge, but to adjust.

2. Banking, Bill Pay & Cash Management

Goal: Keep your day-to-day money organized, automated, and low-maintenance.

Recommended tools & strategies:

Automatic Bill Pay: Set this up directly with your bank or service provider to eliminate missed payments.

Separate accounts by function:

One checking account for bills

One spending account for flexible expenses

One high-yield savings account for short-term goals and your emergency fund

Banks with automation features:

SoFi, Ally, Capital One 360, or Chime for sub-accounts and automatic paycheck splits.

Cash buffer management: use Empower or Wealthfront Cash to automatically route extra cash to higher-yield accounts.

Pro tip:

Treat automation if the foundation – set it up once, and let your money flow smoothly to where you want it.

3. Credit Health & Debt Management

Goal: Track, protect, and strategically reduce what you owe.

Recommended tools:

Experian, Credit Karma, or Credit Sesame – free credit monitoring and improvement suggestions.

Tally – automates credit card debt payments intelligently to minimize interest.

Undebt.it – create a snowball or avalanche payoff plan and track progress visually.

Your credit card app – enable alerts for balance thresholds, due dates, or large transactions.

Pro tip:

Paying off high-interest debt is an investment — use the same mindset you’d apply to growing wealth, just in reverse.

4. Savings & Automation

Goal: Make saving and financial progress happen automatically — before you think about it.

Recommended tools:

Built-in bank automations – set recurring transfers from checking to savings the day after payday.

Qapital – create “rules” like “save $10 every time I hit 10,000 steps” or “round up purchases.”

Digit (now part of Oportun) – analyzes your cash flow and moves small, safe amounts into savings automatically.

SoFi Vaults or Ally Buckets – create labeled savings sub-accounts for goals like “Travel,” “Emergency,” or “Down Payment.”

Pro tip:

Automate based on events, not dates. For example: “when paycheck clears → move $X to Future Self.” It’s more reliable. Some banks and many payroll system allow splitting direct deposits among multiple accounts.

5. Investing & Wealth Building

Goal: Build long-term wealth with automated contributions and diversified portfolios.

Recommended tools:

Betterment, Wealthfront, or M1 Finance – robo-advisors that automate investing and rebalancing.

Fidelity, Schwab, or Vanguard – for those who prefer self-directed investing.

Public or Robinhood – simplified investing apps for small, consistent purchases.

Empower (formerly Personal Capital) – tracks investments and net worth across accounts.

Pro tip:

Set recurring investments and tune out the daily market noise. Long-term investing isn’t about timing or picking winners — it’s about consistently funding your future income stream so your money keeps working even when you’re not.

6. Goal Setting & Financial Exploration

Goal: Translate abstract ambitions into clear, measurable plans.

Recommended tools:

Monarch Money – lets you define financial goals (e.g., “buy a home,” “reach $100k net worth”) and track progress visually.

Notion or Google Sheets – simple for creating a “Financial Dashboard” that consolidates all your goals.

YNAB Goals or Tiller templates – built-in goal tracking linked to your spending data.

Pro tip:

Write your financial goals in terms of behaviors, not outcomes:

“Invest $500/month” instead of “become a millionaire.”

Behaviors you can automate — outcomes you can’t.

7. Retirement Planning & Long-Term Security

Goal: Design a future where work is optional, not required.

Recommended tools:

Empower – combines retirement projections and investment tracking.

NewRetirement – comprehensive planning tool for future cash flow and tax scenarios.

Fidelity’s Retirement Score or Vanguard’s Nest Egg Calculator – quick snapshots to test progress.

Pro tip:

Start early and automate small, consistent contributions — it’s less about strategy, more about time in the market.

8. Protection, Insurance & Contingency Planning

Goal: Protect your system from shocks and keep your data safe.

Recommended tools & practices:

Insurance reviews – use Policygenius or Lemonade to compare coverage annually.

Password manager – 1Password or Bitwarden for securing financial logins.

Document vault – store financial records and policy details in Google Drive or Notion with restricted access.

Identity monitoring – Aura, LifeLock, or Experian IdentityWorks.

Pro tip:

Financial security isn’t just about saving — it’s about making sure one bad event doesn’t erase years of progress.

9. Net Worth Tracking & Financial Awareness

Goal: Stay aware of your overall financial position — without obsessing over every line item.

Recommended tools:

Empower, Monarch, or Tiller – connect all accounts for a single net worth view.

Notion or Google Sheets – manual but flexible dashboards for tracking long-term trends.

Plaid integrations – for connecting multiple institutions securely.

Pro tip:

Check your net worth monthly or quarterly. Progress compounds quietly — watching it grow keeps motivation alive.

Putting It All Together

A modern personal finance stack doesn’t have to be complex. In fact, it works best when each layer handles one clear job:

Start by defining what you want your money to achieve — paying off debt, saving more, or building long-term wealth. Then choose tools that directly support those goals. The best setup is the one that makes your next financial action easier, not the one with the most features. As your goals evolve, update your tools to match where you’re headed.

Common Mistakes & How to Fix Them

Even the best systems can break down if you approach budgeting with the wrong expectations. A modern budget isn’t about control — it’s about clarity, automation, and progress. Here are some of the most common mistakes people make, and how to course-correct before they become habits.

Common Mistakes & How to Fix Them

Even the best systems can break down if you approach budgeting with the wrong expectations. A modern budget isn’t about control — it’s about clarity, automation, and progress. Here are some of the most common mistakes people make, and how to course-correct before they become habits.

1. Overcomplicating Everything

Many people try to manage 30 categories, multiple apps, and endless spreadsheets. The result: burnout.

Fix: Simplify. Start with three core buckets — Essentials, Enjoyment, and Future Self. Once those flows are stable, add detail only where it helps you make better decisions. Complexity is the enemy of consistency.

2. Waiting for the “Perfect” System

You don’t need the perfect tool, the perfect timing, or the perfect plan to start. Progress begins with motion.

Fix: Pick one small automation today — even just a recurring savings transfer or debt payment. The perfect system will emerge through iteration, not planning paralysis.

3. Treating Budgets Like Punishment

Traditional budgeting teaches restriction: “Spend less. Cut more.” That mindset fails because it frames money as deprivation.

Fix: Reframe budgeting as alignment — making your money match your values. Keep an “Enjoyment” category so you can spend intentionally without guilt. A sustainable budget feels empowering, not punitive.

4. Ignoring Feedback

Many people set a plan and never look again until something breaks. Without feedback, you can’t improve.

Fix: Build lightweight reviews into your routine. A quick weekly scan of your spending and a 15-minute monthly reset are enough. Use what you learn to tweak automations, not to criticize yourself.

5. Relying on Willpower Instead of Systems

Motivation fades; systems endure. If your budget depends on you remembering to act, it will eventually fail.

Fix: Automate every recurring decision you can — saving, investing, bill payments, and even spendding alerts. Let software handle behavior so you can focus on goals.

Budgeting doesn’t fail because people lack discipline — it fails because systems lack design. When you simplify, automate, and stay responsive to feedback, your finances begin to run on momentum instead of willpower.

Conclusion

A modern budget isn’t about spreadsheets or strict rules — it’s about creating a system that helps your money move with purpose. The goal isn’t perfection; it’s progress that compounds quietly in the background. When you define your priorities, automate what matters, and check in just enough to stay aligned, you turn budgeting from a chore into a form of self-direction.

Your finances should work for you, not demand constant attention. Start small: set one automation, make one intentional choice, and build from there. Over time, those actions stack into something powerful — a financial system that quietly supports the life you’re building, one decision at a time.